Last night Rachel Azaroff of Alliance of Angels stopped by our Seattle space to help some of our members prepare for successful angel investing pitches. She pointed out it’s a different animal pitching to an angel investor vs. pitching to a venture capitalist, so it’s important to be prepared. Angel investors aren’t professional investors representing a fund; these are people writing checks right out of their personal bank accounts, so the format can be radically different. Here’s what you need to know.

Prepare, Prepare and Prepare Some More

It’s important to know whom you are pitching to. Research your particular angels. You need to know what stage these angels are investing at and what type of investments they make. For example, Alliance of Angels generally invests in early stage startups, and tends to invest in life sciences, consumer goods, IT and clean tech.

10 Minutes or Less, Guaranteed!

Angel investors tend to have ten minute or less pitch sessions, and believe me, they go by faster than you think. Alliance of Angels advises:

Be clear about your value, be compelling and back up your plan with numbers.

You want to find the sweet spot where you can thoroughly explain your idea, but without going into too much detail and running out of time to make the sale. Investors aren’t going to write you a check today, so Rachel recommends that you focus on getting their attention with the goal of scheduling a follow up meeting.

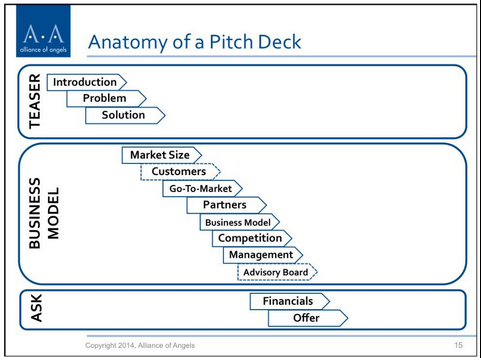

The Anatomy of a Pitch Deck

Problem

Always begin your pitch by describing the problem your idea solves. You want to make sure to define the problem, identify who feels the pain, and illustrate the size and severity of the pain. Rachel says:

Focus on making the pain tangible.

Once you clearly outline the pain point, deliver your value proposition. This is one of the most important slides in your deck, so it may be necessary to use multiple slides in order to fully explain the features and benefits that solve the problem.

Market Size

Ultimately, it’s important to dive into the specifics of your initial target demographic, but you also want to make sure you paint a clear picture of your potential by highlighting the total addressable market. Be realistic, but also sell it. Back up your numbers with third party facts and figures.

Customers

Explain who your customer is. If you can, be specific. For example, in a B2B scenario, you might use logos from the companies you plan to sell to. If you have any existing customers, make sure to highlight them as well. The potential pipeline is also an important part of your customer base. Display customer growth in a realistic and precise way.

Go-To Market Strategy

This is another key part of your pitch. Angel investors want to see exactly how you plan to get users or customers, so it’s important to be clear and strategic with your go-to market plan. If you can, outline the sales cycle and key decision makers–the more specific in this area, the better.

Rachel also suggests outlining any key partnerships. This doesn’t apply to most, but if your business hinges on relationships, be sure to include them in your go to market plan. Show any traction you’ve already made.

Business Model

Startups tend to let the business model “fall out” of the company, meaning the money making part will just naturally work itself out. Remember, angel investors are writing you a check from their personal account; they want to see you are interested in not only returning, but growing their investment. Clearly state how you plan to make money.

Don’t ignore your competition. Address your competitors head-on. Leverage the competition by showing how your product will solve more problems and ultimately be profitable.

Management

You want to give the investors confidence that you and your team know what you are doing, so highlight your key players. Be sure to outline their experience and why they are in their position. If they have prior exits or startup experience, Rachel recommends including that information in your pitch.

Financials

Rachel says this is one of the harder slides, because finances can be convoluted. Stick to three main financial points: revenue and profit, annual projects and key operating drivers. When it comes to the financials slide, ask yourself this question:

How many questions does it answer vs. how many questions does it create?

Practice Makes a Perfect Pitch

As the old adage goes, practice makes perfect. That holds true for an angel investing pitch. Rachel says one of the biggest issues angel investors see in pitching is the presenter not being confident with the presentation. She recommends presenting your pitch to various crowd sizes and in many different spaces. The more variables you are prepared for, the better your pitch will be.

Want to learn more?

Be sure to catch our next event on startup funding at Lunch & Learn: Techstars. You have two opportunities to attend: Friday, April 10th at thinkspace Seattle and Tuesday, April 14th at thinkspace Redmond. Find more information and register for these events at thinkspace connected.

Techstars is the gold standard for startup accelerators. At the core is our massive interconnected network of over 3,000 successful entrepreneurs, mentors, investors and corporate partners helping the most promising startups do more faster. With 13 programs worldwide, the mentorship-driven accelerator program funds the best companies in the most entrepreneurial communities. Since 2006, over 70% of the 500 companies from almost 40 Techstars programs have prospered, representing approximately $2 billion in market capitalization. Techstars is currently accepting applications for their program in Seattle until April 30th and this is your opportunity to meet with Jaren Schwartz, Program Manager for Techstars and learn more about how Techstars can help provide funding for your startup.