First fifteen minutes of “Build Your Board” by Mike Crill

Mike Crill, Managing Director for Atlas Accelerator spoke at thinkspace for our Tech Tuesday event. Mike spoke on “Build Your Board”. He covered things like what types of boards are there, how much to compensate your board, how to measure if your board member is adding value, and we did a fun exercise to determine which type of person to put on your board.

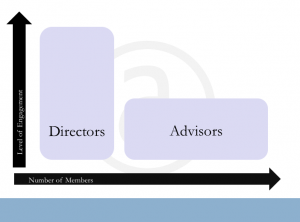

Types of Boards

- Board of Directors (highest level of engagement)

- Advisors Board (lower level of engagement but higher number of members)

- Customer Advisory Board

- Technical Advisory Board

Compensation

Directors

- ½% – 2% option vested 36-48 months

- No cliff, no cash

Advisors

- 1/10th to ½% option vested 36-48 months

- No cliff, no cash

Mike says you’re paying your advisors, you’re giving them equity in your company so you should ask them these two questions and see if you can check either of these boxes.

Ask your Advisory Board Members if they have:

(Two important questions to ask your advisor – 2 min.)

- “Stopped me from doing something I was sure was the right thing to do”

- “Initiated something that was beneficial”

You should be getting something from each of your advisory board members. They should be initiating some new programs or ideas or they should be stopping you from doing things. If they are not, you should really be questioning why they are on your board.

My biggest take away – Dilution

On the topic of dilution: “Don’t worry about the size of the pie, just make sure the pie makes it out of the oven”. So many times you hear about not wanting to dilute your shares. When it comes down to it, you need to surround yourself with smart people that can help you be successful because the cost is too great if you don’t.

Here are the handouts from Mike’s presentation.